- · 4849 friends

Wife Forced to Pay $294,916 to Husband for supporting the wife's two children from a previous marriage.

Emmeran & Emmeran [2022] FedCFamC2F 1507 (15 November 2022)

The parties are in dispute over the assessment of financial and non-financial contributions throughout their relationship. The Court, in determining whether the Husband should receive an adjustment, considered how he financially supported two children from the Wife’s previous marriage who lived with the parties for a lengthy period of time.

Facts

Mr Emmeran and Ms Emmeran commenced cohabitation in 2001, married in 2002 and ceased cohabitation in March 2020, although did not regard their marriage as over until later that year. Arising for determination are their competing applications for orders altering their interests in property. Mr Emmeran proposes that he receives a payment of $309,705 from Ms Emmeran such that he retains 60% of the value of the parties’ interests in non-superannuation assets. He also proposes a split from Ms Emmeran’s superannuation of $44,025 such that he retains 60% of the value of the parties’ superannuation.

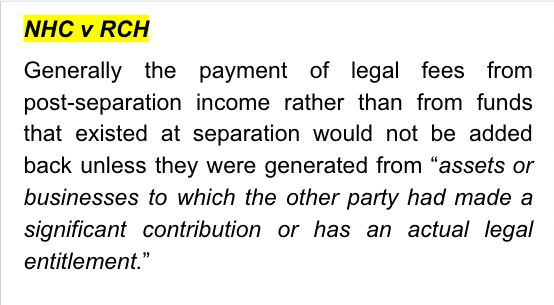

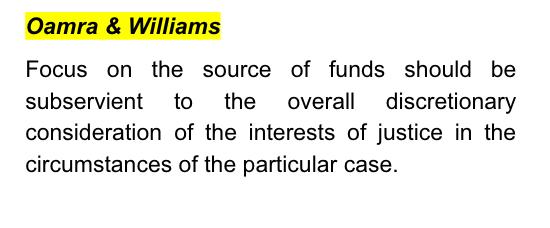

Ms Emmeran proposes that she pay Mr Emmeran the sum of $239,920.50 such that the parties’ each retain an equal value of the parties’ non-superannuation assets. She proposes no alteration to the parties’ interests in superannuation. Mr Emmeran proposes that Ms Emmeran’s paid legal fees be added back to the assets available for distribution. Ms Emmeran opposes that proposal. It is common ground that she has paid $17,653 in legal fees to date.

Mr Emmeran has paid no legal fees. Both parties have liabilities to their legal representatives. Ms Emmeran applied funds to her legal fees from her savings which had essentially accumulated after the parties ceased cohabiting. As has been referred to, the parties did not then consider their marriage to be over, rather it was agreed Mr Emmeran would move out due to particular consequences of the COVID-19 pandemic for them and their extended family. For approximately 6 months thereafter, the parties made no substantive changes to their financial arrangements that involved a pooling of their respective incomes. For approximately a further year thereafter, Mr Emmeran made substantial contributions to the parties’ joint expenditure, including their mortgage for the home then occupied by Ms Emmeran.

Over that 18 month period, Mr Emmeran applied approximately $17,700 of his income to the mortgage. During that period, Ms Emmeran applied approximately $10,563 from her savings to her legal fees and accumulated other savings. She had also received a tax refund of approximately $8,581 for the Financial Year ending 30 June 2020, a year during which the parties had largely continued their relationship.

Issue

Whether or not the Husband should receive an adjustment.

Applicable law

Family Law Act 1975 (Cth) s 79(4) - requires the Court to take into account the parties’ financial and non-financial, direct and indirect, contributions to the acquisition, conservation or improvement of property.

Analysis

Until Ms Emmeran obtained employment as a health care worker in approximately 2007, the only income she received was by way of Family Tax Benefit payments from the government and six months of sole parenting payments in 2001. Mr Emmeran overwhelmingly financially supported J and K for approximately 5 years, before their costs were more evenly shared between the parties for the remainder of the relationship. Ms Emmeran had a legal duty to maintain the children of her prior relationship and Mr Emmeran had no such legal duty to maintain them. Accordingly, “in contributing to the support of these children the wife was merely honouring a legal obligation which she owed to the children, whilst the husband, in making his contribution, was acting essentially as a volunteer assisting the wife in the discharge of her legal obligations.”

Mr Emmeran accepted in cross-examination that in marrying Ms Emmeran, he made a commitment to her children. He also agreed that he treated Ms Emmeran’s children as a father would, that he enjoyed a strong relationship with them and received the rewards and benefits of parenting them.

Conclusion

The Wife pay to the Husband's solicitors Keith A Elliot Pty Ltd on behalf of the Husband the sum of $294,916 ("the payment") on or before the 2nd day of December 2022 ("the date"). Assessment of the relevant factors, in particular the substantial discrepancy between the parties’ income and Mr Emmeran’s contributions to the welfare and support of Ms Emmeran’s children, warrant an adjustment in his favour of 7.5%. The same adjustment ought be applied both to the non-superannuation and superannuation assets, which would leave Mr Emmeran in a stronger position by $88,721 with respect to the former and $43,247 with respect to the latter, equating to a differential between the parties’ overall positions of $131,968.