- · 4853 friends

Husband Seeks Adjustment of Property Settlement Orders

Emmeran & Emmeran [2022] FedCFamC2F 1507 (15 November 2022)

The parties dispute whether the Husband should receive an adjustment where he financially supported two children from the Wife’s previous marriage who lived with the parties for a lengthy period of time. The Court, in making its orders, assessed financial and non-financial contributions throughout the relationship.

Facts

Mr Emmeran and Ms Emmeran commenced cohabitation in 2001, married in 2002 and ceased cohabitation in March 2020, although did not regard their marriage as over until later that year. Arising for determination are their competing applications for orders altering their interests in property. Mr Emmeran proposes that he receives a payment of $309,705 from Ms Emmeran such that he retain 60% of the value of the parties’ interests in non-superannuation assets. He also proposes a split from Ms Emmeran’s superannuation of $44,025 such that he retain 60% of the value of the parties’ superannuation.

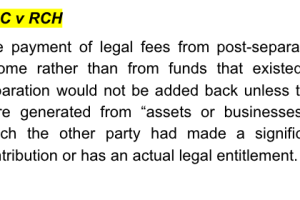

Ms Emmeran proposes that she pay Mr Emmeran the sum of $239,920.50 such that the parties’ each retain an equal value of the parties’ non-superannuation assets. She proposes no alteration to the parties’ interests in superannuation. Mr Emmeran proposes that Ms Emmeran’s paid legal fees be added back to the assets available for distribution. Ms Emmeran opposes that proposal.

It is common ground that she has paid $17,653 in legal fees to date. Mr Emmeran has paid no legal fees. Both parties have liabilities to their legal representatives. Ms Emmeran applied funds to her legal fees from her savings which had essentially accumulated after the parties ceased cohabiting.

The parties did not then consider their marriage to be over, rather it was agreed Mr Emmeran would move out due to particular consequences of the COVID-19 pandemic for them and their extended family. For approximately 6 months thereafter, the parties made no substantive changes to their financial arrangements that involved a pooling of their respective incomes. For approximately a further year thereafter, Mr Emmeran made substantial contributions to the parties’ joint expenditure, including their mortgage for the home then occupied by Ms Emmeran. It is common ground that over that 18 month period, Mr Emmeran applied approximately $17,700 of his income to the mortgage.

During that period, Ms Emmeran applied approximately $10,563 from her savings to her legal fees and accumulated other savings. She had also received a tax refund of approximately $8,581 for the Financial Year ending 30 June 2020, a year during which the parties had largely continued their relationship.

Issue

Whether or not the Husband should receive an adjustment where he financially supported two children from the Wife’s previous marriage who lived with the parties for a lengthy period of time.

Applicable law

Family Law Act 1975 (Cth) s 79(4) - provides that the court is required to take into account the parties’ financial and non-financial, direct and indirect, contributions to the acquisition, conservation or improvement of property.

Analysis

Ms Emmeran developed her significant earning capacity that exceeds $100,000 per annum during the parties’ 18 year marriage. She had the benefit of income from Mr Emmeran during the period in which she was able to accumulate funds to pay her legal fees. Ms Emmeran did not establish that Mr Emmeran was able to pay his legal fees which are anticipated to be owing in the amount of approximately $41,000. He nevertheless made contributions to Ms Emmeran’s household which persisted for 18 months after he left the former matrimonial home from his more modest income of approximately $65,000 per annum.

It would create an injustice for Ms Emmeran’s paid legal fees not to be added back. Given her ultimate concession that the totality of her savings ought be included in the assets to be divided between the parties had she not paid her legal fees from those savings, there would have been an increase in the funds available for distribution to Mr Emmeran by the same sum. To fail to add back Ms Emmeran’s paid legal fees would have the effect of requiring Mr Emmeran to contribute to her legal costs contrary to the position enshrined in subsection 117(1) of the Act.

Conclusion

The Wife should pay the Husband's solicitors Keith A Elliot Pty Ltd on behalf of the Husband the sum of $294,916 ("the payment") on or before the 2nd day of December 2022 ("the date").