- · 4851 friends

Appellant Opposes Previous Property Orders

Zaher & Zaher [2022] FedCFamC1A 124 (8 August 2022)

The primary judge found that a property had been purchased using sale proceeds from a sale yet to occur. The Court, deciding the appeal, assessed the reasons about the parties’ respective financial contributions and how they reflected in the ultimate division of property.

Facts:

The parties hail from Country B and arrived together in Australia in 1987 using forged visas. They were accompanied by three children. It transpired that one of the children was in fact the respondent’s brother. The respondent bore two more children after her arrival in Australia and alleged the appellant is the biological father of her four children, but the appellant denied his paternity of them all. The appellant declined to submit to paternity testing to definitively settle the dispute and so the primary judge inferentially found his paternity was established (at [75]).

Notwithstanding the deception practised upon the Australian immigration authorities, the parties and the children were all granted permanent residence status in 1991. Not only did the appellant deny his paternity of the children, he denied the parties were ever married or lived in a de facto relationship, notwithstanding they lived in the same residence from the time they arrived in Australia. During that time they occupied several homes, at least one of which they jointly owned. The parties separated in 2014.

In 2015, the appellant bought and registered in his own name a residential property (“the Suburb C property”), which he then occupied. He denied the respondent lived there, but the respondent and an adult child alleged they did until they vacated the property in September 2019 when it was razed by fire. The parties conducted the proceedings upon the premise that the only assets available for division between them were the Suburb C property (the unimproved land value of which was about $1 million, net of the mortgage debt) and an insurance payout for the destroyed home ($702,644). Unless and until any adjustment order was made under the Act, the appellant enjoyed exclusive legal proprietary interest in those two assets.

The appealed orders were made and reasons were published in March 2022, commendably promptly after the trial was concluded. The effect of the orders was to divide the assets equally, by requiring the sale of the Suburb C property and the equal distribution of both the net sale proceeds and the insurance payout.

Issue:

Whether or not the appeal should be granted.

Applicable law:

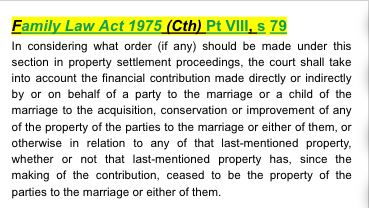

Family Law Act 1975 (Cth) Pt VIII, s 79 - in considering what order (if any) should be made under this section in property settlement proceedings, the court shall take into account the financial contribution made directly or indirectly by or on behalf of a party to the marriage or a child of the marriage to the acquisition, conservation or improvement of any of the property of the parties to the marriage or either of them, or otherwise in relation to any of that last-mentioned property, whether or not that last-mentioned property has, since the making of the contribution, ceased to be the property of the parties to the marriage or either of them.

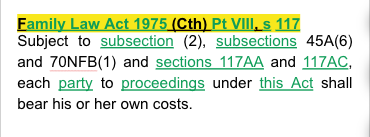

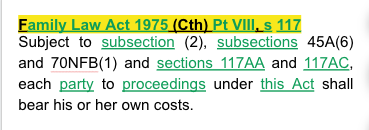

Family Law Act 1975 (Cth) Pt VIII, s 117 - subject to subsection (2), subsections 45A(6) and 70NFB(1) and sections 117AA and 117AC, each party to proceedings under this Act shall bear his or her own costs.

Pettitt v Dunkley [1971] 1 NSWLR 376 - provides that the lack of clarity in the reasons about the parties’ respective financial contributions and how they reflected in the ultimate division of property was a material error of law.

Analysis:

The primary judge accepted the appellant received gross compensation of $370,000 from a personal injury claim at some point during the marriage (at [96]), but there was no evidence of the net sum actually received by the appellant or precisely how it was spent. As a consequence, the reasons are silent about the appellant’s financial contribution in that regard.

The primary judge did not accept the appellant’s evidence about his direct financial expenditure of $200,000 on renovations to the Suburb C property (at [97]) but, if the appellant received damages from his personal injury claim, the money must have been spent somehow.

The respondent accepted at trial the appellant had little or no savings. The reasons inadequately deal with that aspect of the evidence concerning the appellant’s financial contributions.

Conclusion:

The appeal succeeds, in large measure, for the material legal error of insufficient reasons. The parties’ respective applications for costs certificates for both the appeal and the re-hearings are granted.