- · 4849 friends

Wife Opposes Final Property Orders

Goldsmith & Stinson [2022] FedCFamC1A 96 (30 June 2022)

The primary judge made final property orders where a percentage adjustment was made in favour of the husband. The wife filed an appeal against the final property orders. The Court, in deciding whether the appeal should be granted, assessed the adequacy of the primary judge's reasons.

Facts:

The spouses commenced cohabitation in 2004 in northern New South Wales and each introduced assets into the relationship. The wife was a professional and the husband operated and owned a skilled professional activities business in Town A.

In 2000, the husband’s father purchased two rural properties in the region, known as ‘Property D’ and ‘Property P’. The interest that the parties had in these properties was a matter of controversy at the first trial. This was in circumstances where the parties had constructed their family home on Property D.

The parties finally separated in 2017, although they continued to live under one roof until 2019. They have two children together, now aged 15 years and 12 years.

The children lived with the wife and spend five nights per fortnight and half of the school holidays with the husband. At the time of the first trial, the husband’s elderly father (who was a party to those earlier proceedings) was alive, however, he passed away in 2018 before final orders were pronounced.

Before the primary judge, the husband’s interest as a beneficiary under the Will of his late father had crystallised, such that the property pool was mostly agreed at a net sum of $5,254,763. The orders made by the primary judge effected a division of the property whereby 42.5 percent was given to the wife and 57.5 percent to the husband.

At the trial, the wife contended that she should receive or retain 60 percent of the parties’ property interests, whilst the husband submitted that the wife should receive or retain 35 percent of the matrimonial property pool. The wife sought to adduce and rely upon an affidavit filed on 14 February 2022 relating to her employment as a professional for a period that ended in October 2021.

On 22 February 2022, the wife received and accepted an offer of employment, such that at the time of the appeal hearing, she was employed on a salary of $170,000 plus superannuation. The Amended Application in an Appeal filed 1 March 2022 sought to adduce new evidence of the wife's recent employment – essentially to observe the requirements of full disclosure and to inform the Court of the change in her employment subsequent to 14 February 2022.

The wife's first affidavit was directed to the finding of the primary judge at [82] that “the [wife] has recently obtained employment with a salary package of $182,000”, the evidence now offered by the wife is that she again has accepted a position with a similar salary package.

The wife challenges the percentage adjustment made in the husband’s favour by the primary judge after taking into account the husband’s post-separation inheritance and the failure of the primary judge to make an adjustment in favour of the wife. However, the husband contends that there is no utility in admitting the further evidence where the finding of fact at [82] is not in any way disturbed by the new evidence.

Issue:

Whether or not the primary judge's reasons were inadequate.

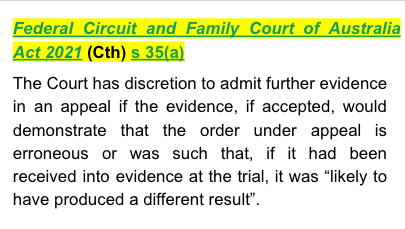

Applicable law:

Analysis:

The husband’s father had informed him that he should treat the properties as his own. The parties, when given an opportunity to acquire, for example, Property P in 2000, declined as they could not afford to do so. This demonstrates that at least the husband's father felt his interest was of some value.

Certainly, the husband, as the only child of the deceased, held an expectation that he would inherit the properties, but these unchallenged facts do not support a finding that the husband had an “unassailable claim” because it was clear that the husband’s father had used his funds to acquire the properties, continued to pay the rates and insurances since 2000, and did not charge the parties any rent for living on Property P after they completed construction of their home in early 2008, nor did he charge any agistment for the livestock they ran on the property (at [14]).

The discretionary assessment of a 7.5 percent adjustment to the husband (equivalent to, in effect, 15 percent of the property pool or $788,214) was well within the broad discretion available to the primary judge because it represents a mathematical discount on the highest amount for the value of the three properties “adjusted”, as the primary judge found was appropriate, from $1,940,000 to $1,340,000.

The asserted error at [82] where the primary judge found the wife “has recently obtained employment with a salary package of $182,000” could not be maintained at the appeal. The primary judge identified that the employment was probationary and that the parenting arrangements meant the wife “is unable to relocate to a place where her employment prospects may be better".

Conclusion:

The wife’s Amended Application in an Appeal filed 1 March 2022 is dismissed. The appeal is dismissed. The wife should pay the costs of the husband fixed in the sum of $14,500 within sixty (60) days.