- · 4772 friends

Husband Appeals Property Settlement Orders

Monteiro & Monteiro [2022] FedCFamC1A 86 (3 June 2022)

The husband filed an appeal against final property settlement orders asserting that post separation liabilities are not bound to be included in the balance sheet. The wife filed a cross-appeal from the primary judge’s failure to add-back a sum of money to the balance sheet. The Court, in making its final orders, assessed the weight the primary judge attributed to the evidence.

Facts:

The parties met in 1988, married in 1991, separated around June 2008 and divorced in 2014. They have two children from their relationship, the eldest of whom is 23 years of age and the youngest 17. The parties had bought and sold various properties and undertook a range of property development projects over the years. They also acquired a business and purchased a one-third interest in a company through the Monteiro Family Trust.

In 2004, the parties moved into what was then the wife’s parents’ house (which is the Suburb A property). Following the wife’s father’s death, the parties continued to live in the Suburb A property with the wife’s mother. In 2008, the parties purchased the Suburb A property from the wife’s mother for an agreed price of $500,000, of which they paid $400,000, with the remaining $100,000 being provided by way of vendor finance. The parties and the wife’s mother entered into an agreement whereby she would remain living at the property rent free for her lifetime or until the property was sold. The $100,000 had not been repaid to the wife’s mother at the time of trial, and the wife’s mother remained living in part of the Suburb A property.

In 2005, the parties established the Monteiro Retirement Fund, which is a self-managed superannuation fund, with each party rolling their personal superannuation into the fund. The fund purchased a property at Suburb C (“the Suburb C property”) in the same year. In April 2008, the parties purchased the Suburb B property, into which the husband initially moved at separation. The wife remained living in the Suburb A property where she and her mother still reside.

In 2009, the parties refinanced their existing debt structure with ANZ Bank. At the time of trial, the parties had five different loan accounts all secured against the Suburb A property, although one of those loans was secured against the Suburb B property as well. In 2011/2012, the parties’ company went into liquidation. The husband and his business partner continued to work in the company and an agreement was later reached whereby the husband and his partner would purchase the business from the liquidators. This occurred and the husband and his partner set up X Pty Ltd.

The trial commenced on 20 April and concluded on 23 April 2021. The primary judge concluded that the parties’ contribution based entitlements were equal but that the factors under s 75(2) of the Family Law Act 1975 (Cth) justified a 60/40 split in favour of the wife. By his Notice of Appeal filed 31 December 2021, the husband appeals from the orders providing for a 60/40 division of property in favour of the wife and a number of other orders.

Issues:

I. Whether or not the overall division of the parties’ property of 60/40 per cent in favour of the wife was unreasonable.

II. Whether or not the primary judge erred in not including a personal debt of the husband in the balance sheet.

Applicable law:

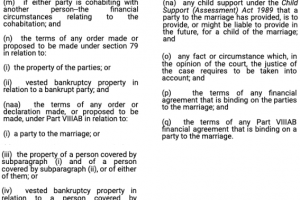

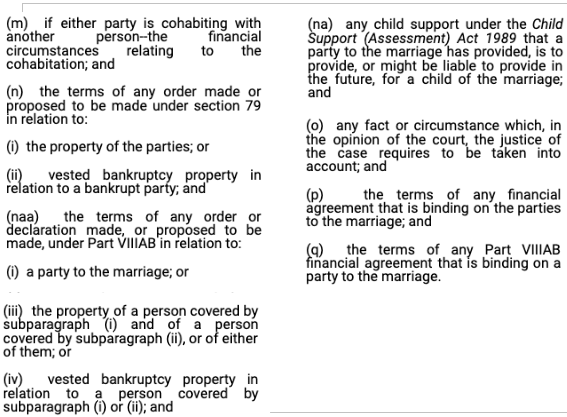

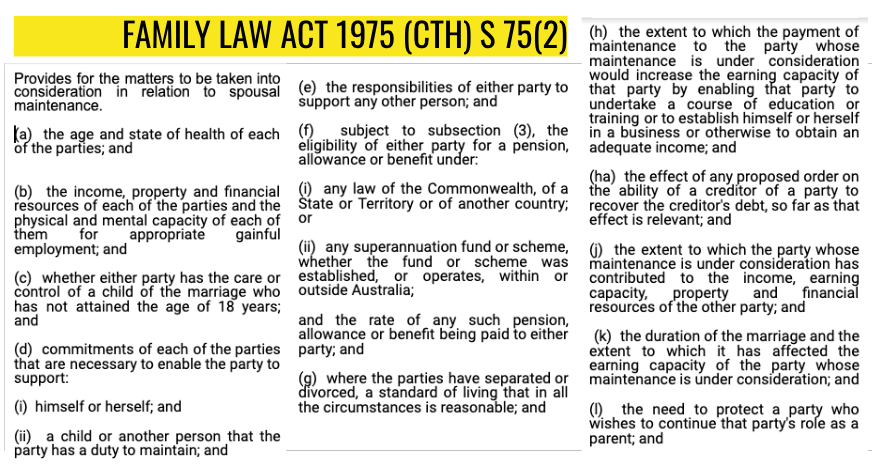

Family Law Act 1975 (Cth) s 75(2) - provides for the matters to be taken into consideration in relation to spousal maintenance.

Analysis:

No challenge is made by the appeal to the finding by the primary judge that the parties’ contribution based entitlements were equal, rather it is said that the final outcome of a 60/40 division was simply not open. However, the husband himself argued for a 60/40 contribution based entitlement in his favour, together with (it seems) some further s 75(2) adjustment benefiting him as well. He could not explain how that contended adjustment was reasonable, but a 60/40 split in favour of the wife was not. Given that no challenge is made to the equal contribution finding, that the failure to successfully impugn the primary judge’s s 75(2) adjustment, which resulted in the 60/40 division, means that the overall outcome is justifiable.

To the extent the loan was explained, it appears to have been in relation to outgoings and unpaid rent for the Suburb C property between 2011 and 2019, together with interest on those amounts. In other words, the loan account was attributable to the post-separation living expenses for the husband and his new partner. The parties agree that items such as their present savings, household contents, motor vehicles, credit card debts and other personal debts should not be brought to account in calculating the net asset pool. Hence to the extent the evidence permitted any conclusion, the loan account plainly was a personal debt. Moreover, such post separation liabilities are not bound to be included in the balance sheet.

Conclusion:

The appeal and cross-appeal are dismissed. The husband should pay the wife the sum of $6,467.28 in respect of her costs within 28 days.